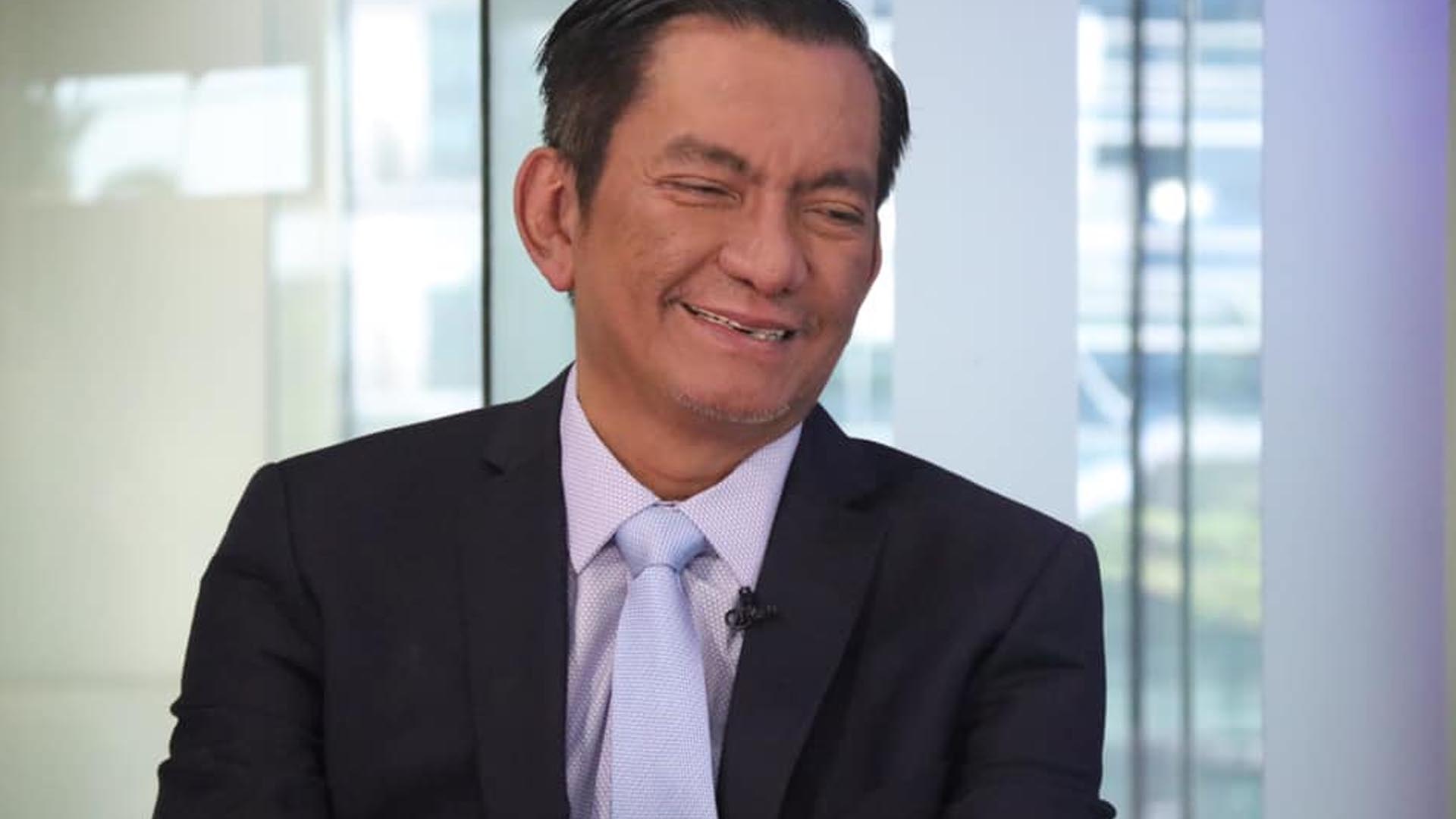

Following President Rodrigo Duterte’s latest order to ban vaping only in public places, the House of Representatives would now propose the imposition of higher taxes on vaping products, Albay Rep. Joey Salceda said.

Earlier, the chairman of the House Committee on Ways and Means said the Chamber will remove from its proposal the additional taxes on vaping products after President Duterte ordered a total ban on the use and importation of e-cigarettes.

“Upon listening to the President last night that he only wants to ban vaping on public places, it’s no longer a ban, it’s just like another smoking restriction, so we are adjusting,” Salceda said in an ambush interview.

“Given the logic of the initial reported ban – precautionary principle- we might as well go for a higher rate than the PHP25/ml as approved by the House, to PHP45/ml, which is the original proposal of the Department of Finance,” he said.

Salceda said raising taxes for vaping products is justifiable since there are far fewer vape users than tobacco smokers.

He said there are about 1 million vape users in the country, who are almost totally in the upper-middle to high-income classes. On the other hand, there are approximately 23 million smokers, with 7 million in the lowest 50 percent of society.

“The entry cost to vaping is also relatively high at PHP1,600. So, effectively, we are making it more prohibitive,” Salceda said.

He also pointed out that raising taxes on a product does not have the effect of an actual ban.

“Taxation is not an instrument for banning. We just make it more prohibitive to reduce its consumption. So whether you do it at home or anywhere else, you have to pay PHP45/ml,” he said.

But since the House had approved House Bill 1026 on final reading, lawmakers will push for the higher taxes on vaping products when the measure is deliberated with the Senate at the bicameral conference committee.

Besides increasing taxes on vaping products, HB 1026 also seeks to increase taxes on alcohol and some tobacco products. (PNA)