Ayala Land, Inc. (ALI) posted a 12-percent increase in net income to PHP23.2 billion for the first 9 months of 2019 as total revenues increased by 2 percent to PHP121.7 billion for the period.

Growth was driven primarily by real estate revenues which stood at PHP119.7 billion, supported by office, commercial and industrial lot sales and further boosted by the improving performance of new leasing assets.

ALI launched PHP37.8B worth of residential projects in the third quarter alone, bringing total launches for the first nine months of the year to PHP57.3 billion.

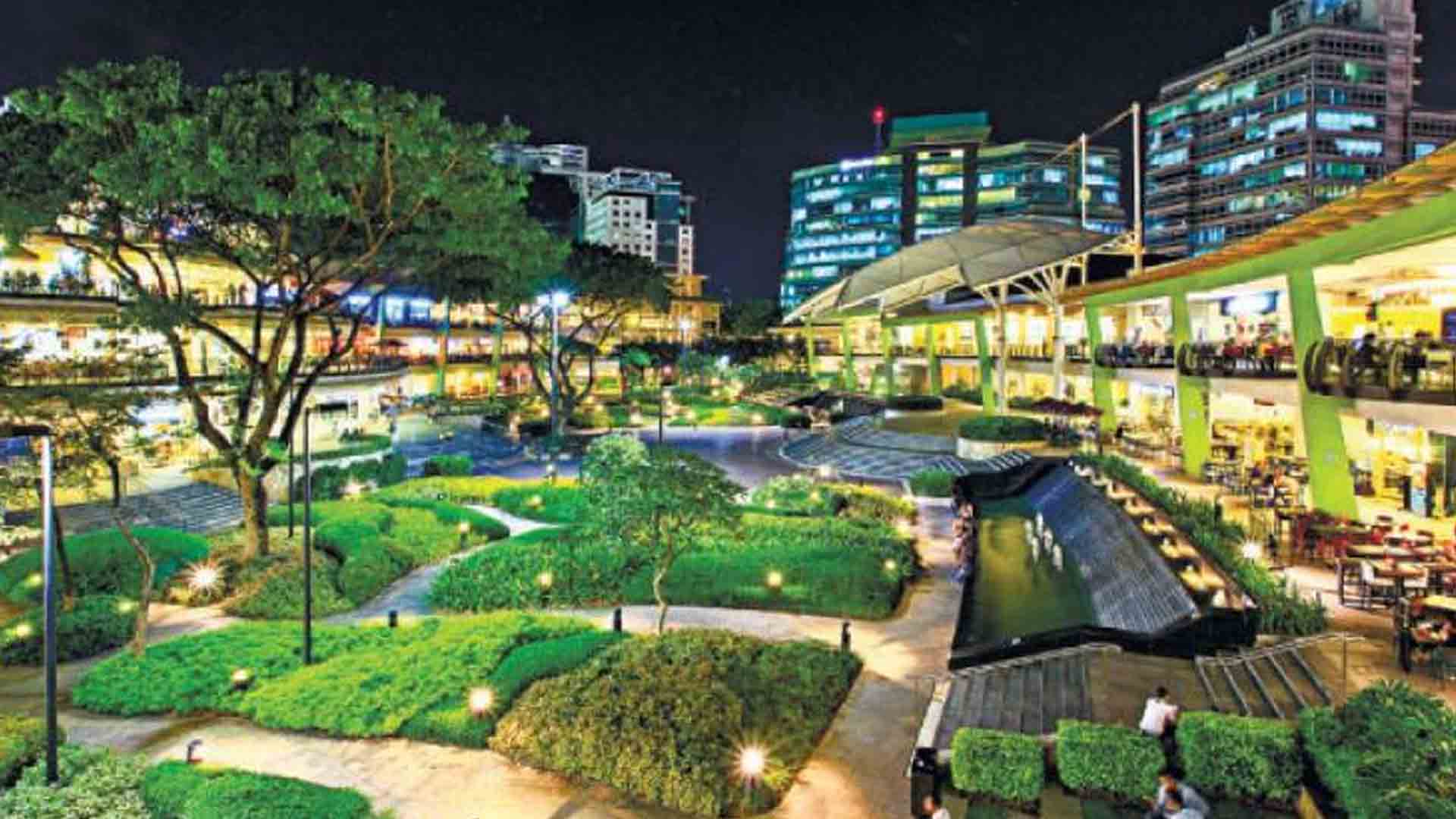

Capital expenditures reached PHP78.2 billion for the period, supporting continued residential and leasing asset build-up with the malls and offices segments, expanding their gross leasable area (GLA) further to 2.1 million and 1.2 million square meters, respectively.

“Third-quarter financial results were in line with our expectations, following a similar pattern to what we have seen in the first half of the year. We, however, launched more developments during the period, which we anticipate will help us finish strong in 2019 and provide positive momentum in 2020,” ALI president and chief executive officer Bernard Vincent Dy said in a statement.

“Commercial leasing assets, on the other hand, continue to outperform as business and consumer activity remain robust, and as more completed assets over the last couple of years stabilize and experience high occupancy rates,” he said.

ALI’s property development revenues amounted to PHP85.4 billion with contributions from a 51-percent growth in office for sale revenues to PHP11.1 billion, and a 16-percent increase in sales of commercial and industrial lots to PHP6.5 billion.

The company’s commercial leasing business expanded with total revenues up 16 percent to PHP27.6 billion, while shopping center revenues grew 10 percent to PHP15 billion.

Revenues from office leasing also jumped 26 percent to PHP7.2 billion, while the hotels and resorts segment grew its revenues by 17 percent to PHP5.4 billion. (PR)